Relationship between Foreign Direct Investment and Company Taxation: Case of Bangladesh

DOI:

https://doi.org/10.18034/ajtp.v3i1.394Keywords:

Company Taxation, Corporate Tax Rate, Foreign Direct Investment (FDI), GDP, BangladeshAbstract

This study looks at the association between foreign direct investment and company taxation in Bangladesh from 2001-2010. The annual reports were sourced from the Bangladesh Bank Bulletin, Bangladesh Bureau of Statistics (BBS) and World Bank which was analyzed using Descriptive Statistic, correlation and regression. The independent variable corporate taxation was measured using corporate tax rate (CTR) whilst dependent variable foreign direct investment was measured using FDI net inflow (% of GDP). GDP, exchange rate and inflation rate were used as control variables. The result showed negative significant relationship between CTR and FDI whereas exchange rate and FDI indicated negative insignificant relationship. On the other hand, GDP was positively insignificantly related with FDI whilst inflation had positive significant relationship with FDI. Based on the result, the study suggested that there is require for the government to lo trim down corporate tax rate in order to create a centre of attention FDI into the country.

Downloads

References

Adepeju, B. S. (2012). The Impact of Tax Incentives on Foreign Direct Investment in the Oil and Gas Sector in Nigeria. Journal of Business and Management, 6(1), 01-15.

Ahmed AA and Dey MM. 2011. Accounting Disclosure Scenario: An Empirical Study of the Banking Sector of Bangladesh Accounting & Management Information Systems, 9.

Ahmed AA and Hossain MS. 2010. Audit Report Lag: A Study of the Bangladeshi Listed Companies ASA University Review, 4, 49-56.

Ahmed AA and Neogy TK. 2010. FORENSIC ACCOUNTING IN BANGLADESH: EMERGENCE AND INTRODUCTION Development Compilation, 3, 71-82.

Ahmed AA. 2009. Measurement and Analysis of the Extent of Timeliness in Corporate Annual Reports of Banking Sector in Bangladesh Development Compilation, 1, 45-56.

Ahmed AA. 2009. THE EFFECT OF TIMELINESS REGULATION OF CORPORATE FINANCIAL REPORTING: EVIDENCE FROM BANKING SECTOR OF BANGLADESH Accounting and Management Information Systems, 8, 216 - 235.

Ahmed AA. 2012. Disclosure of Financial Reporting and Firm Structure as a Determinant: A Study on the Listed Companies of DSE ASA University Review, 6, 43-60.

Broadway, R. (1978). Investment Incentives, Corporate Taxation, and efficiency, in the Allocation of capital. The Economic Journal, 88, 480-481.

Cassou, S. P., 1997, The link between tax rates and foreign direct investment, Applied Economics 29, 1295-1301. DOI: https://doi.org/10.1080/00036849700000019

CITA (2007). Company Income Tax Act. Retrieved from http://www.fointernational.com/wp content/uploads/ 2013/05/Companies-Income-Tax-Act-LFN-2004.pdf

Davies, R. B. (2004). Tax Treaties and Foreign Direct Investment: Potential versus Performance. International Tax and Public Finance. 10, 775–802. DOI: https://doi.org/10.1023/B:ITAX.0000045331.76700.40

De Mooij, R., & Ederveen, S. (2003). Taxation and Foreign Direct Investment: A Synthesis of Empirical Research. International Tax and Public Finance 10, 673- 693. DOI: https://doi.org/10.1023/A:1026329920854

Desai, M. Fritz F. & James H. (2004). Foreign Direct Investment in a World of Multiple Taxes. Journal of Public Economics, 88(12), 2727-2744.' DOI: https://doi.org/10.1016/j.jpubeco.2003.08.004

Dike, C. M. A. (2014). An Overview of the Nigerian Tax System: Implications for foreign investors. At the Nigerians in despora organiation (NIDO) UK south Investment Conference on the 17th- 18th March, 2014.

Ekpung, E. G., & Wilfred, O. W. (2014). The Impact of Taxation on Investment and Economic Development in Nigeria. Academic Journal of Interdisciplinary Studies, 3(4) 209-318.

Fakile, A. S. & Adegbile, F. F. (2011). Tax Incentives: Tool for Attracting Foreign Direc Investment in Nigerian economy. International Journal of Research in Commerce and Management, 2(2), 87 105.

Faruk, M. (2015). The Effect of FDI to Accelerate the Economic Growth of Bangladesh and Some Problems & Prospects of FDI. Asian Business Review, 2(2), 37-43. DOI: https://doi.org/10.18034/abr.v2i2.302

Gropp, R. & Kostial, K. (2001). FDI and Corporate Tax Revenue: Tax Harmonization or Competition? Finance and Development, 38(2): 10-13.

Hartman, D. G. (1984) Tax policy and foreign direct investment in the United States, National Tax Journal 37, 475-488.

Islam, K. (2015). Foreign Direct Investment (FDI) in Bangladesh: Prospects and Challenges and Its Impact on Economy. Asian Business Review, 4(1), 24-36. DOI: https://doi.org/10.18034/abr.v4i1.277

Li, Z., & Jiang, J. (2014). Problems and Strategies of Cross-border Mergers and Acquisitions for Chinese Enterprises. ABC Journal Of Advanced Research, 3(1), 29-33. DOI: https://doi.org/10.18034/abcjar.v3i1.29

Morisset, J. (2000). Foreign Direct Investment in Africa: Policies also Matter. Transactional Corporation, 9, 107-25.

Morisset, J. (2003). Using Tax Incentives to Attract Foreign Direct Investment. Retrieved from http://www.rru.worldbank.org.documents.

Okoi, W. W., & Edame, E. ( 2013). The Impact of Taxation on Economic Development in Nigeria: A Case of Small Scale Businesses in Calabar Metropolis (1980-2010). Calabar: Department of Economics, Unpublished PGD Economics Thesis.

Quader MT, Neogy TK and Ahmed AA. 2010. Econometric Growth Rates Analysis of Basic Bank Limited in Bangladesh: an Evaluation Development Compilation, 4, 48-60.

Rahman, M., & Ahsan, M. (2015). Foreign Direct Investment as an Instrument for promoting Economic Development in Bangladesh. Asian Business Review, 3(4), 100-107. DOI: https://doi.org/10.18034/abr.v3i4.285

Rouf MA, Hasan MS and Ahmed AA. 2014. Financial Reporting Practices in the Textile Manufacturing Sectors of Bangladesh ABC Journal of Advanced Research, 3, 57-67.

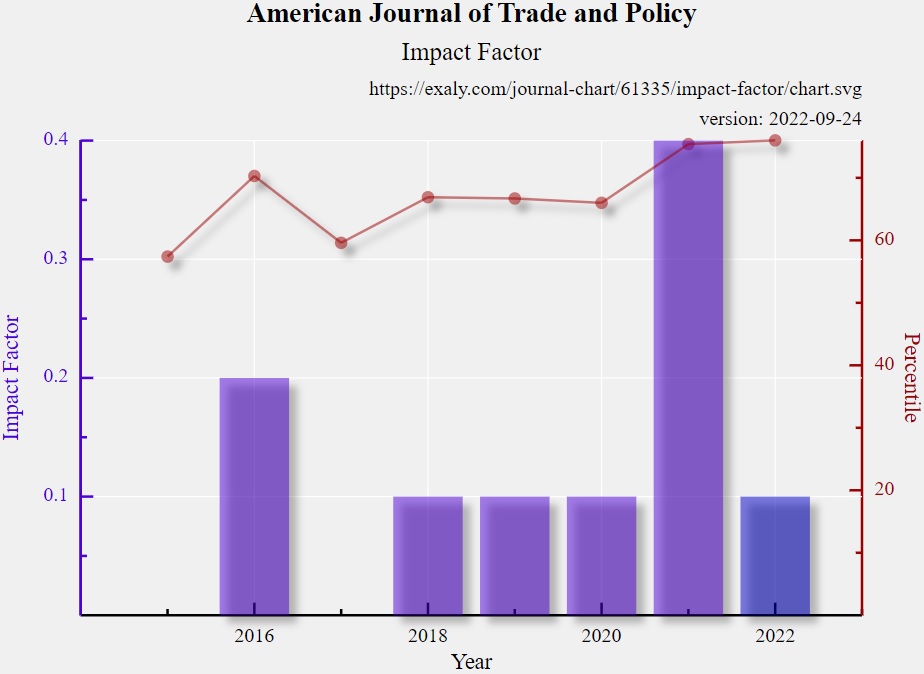

Sadekin, M., Muzib, M., & Al Abbasi, A. (2015). Contemporary Situation of FDI and its Determinants: Bangladesh Scenario. American Journal Of Trade And Policy, 2(2), 121-124.

Tan, A., & Ismail, N. (2015). Foreign Direct Investment, Sovereign Debt and Growth: Evidence for the Euro Area.American Journal Of Trade And Policy, 2(1), 51-58. DOI: https://doi.org/10.18034/ajtp.v2i2.383

Ugochukwu, U. S., Okore, O. A., & Onoh, J. O (2013). The Impact of Foreign Direct Investment on the Nigerian Economy, .International Journal of Research in Commerce and Management. Volume No.2, Issue No. 2 5(2), 25-33.

Young, K. H. (1988). The effects of taxes and rates of return on foreign direct investment in the United States, National Tax Journal 41, 109-121.

--0--

Downloads

Published

Issue

Section

License

American Journal of Trade and Policy is an Open Access journal. Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal the right of first publication with the work simultaneously licensed under a CC BY-NC 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of their work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal. We require authors to inform us of any instances of re-publication.